Market Update

April 10, 2013Market Update

MARCH MARKET PERFORMANCE

Global economies

Global economies have been dominated by the issues surrounding US spending cuts and the continued Eurozone debt issues – further highlighted last month by the Cyprus bailout.

While emerging market economies have continued to remain in recovery mode, the growth outlook continues to remain positive and is expected to improve over the next one to two years.

US Economy

In the US, while the March ISM manufacturing data was slower than expected, returning 51.3 compared to 54.2 in March, it represented the 45th consecutive month of growth.

The data continues to improve as a result of the pick-up in housing activity, lower energy costs, improving consumer confidence and solid corporate earnings.

From a US housing perspective, the widely used S&P/ Case-Shiller housing data (March 27 release) showed residential real estate prices across 20 cities had increased 8.1% in January. This is the largest increase since June 2006.

Monetary policy remains at the forefront of the Federal Reserve’s (Fed) agenda, with the Central Bank of the view that there will be no change in the accommodative policy over the near to medium term.

The Fed has further indicated that the target unemployment rate of 6.5% (currently 7.6% in March) needs to be attained before any changes to monetary policy are implemented.

Staying on the unemployment theme, while the job growth (non – farm payrolls) seen in February increased by 236,000, and only 88,000 in March, the improvement has fallen short of the necessary jobs growth to take the unemployment rate back to the desired 6% – 6.5% level.

The US economy had a better than expected GDP result of 0.4% in the 4th quarter of 2012. This was primarily a result of the increased investment in plant and equipment.

However, the economy remains sluggish despite improved housing and manufacturing data, and reinforces the Federal Reserve’s continuation of easy monetary policy.

Europe

Over to Europe, and markets have been dominated by the debt issues in Cyprus and the subsequent €10b bailout by the European Union (EU) and International Monetary Fund (IMF).

The bailout represented a significant departure from other global bailouts; where, in the Cyprus case, bank depositors with less than €100,000 pay a one off tax of 6.75% and those over the threshold pay 9.9% in tax.

Consumer confidence in the Eurozone area as a whole remained unchanged during March, after increases earlier in the year.

The current turmoil in Cyprus is likely to be another concern on people’s minds going forward, as the country’s economic uncertainty hampers the wider Eurozone recovery.

China

Over in the East, Chinese PMI Manufacturing data continued to improve in March. The improvement was led by increased demand in exports and investments.

To housing, the Chinese Government has been focused on the over inflation of the housing market, and has introduced measures to control speculative investment. Real estate sales growth slowed to 10.4% year on year (yoy), the slowest growth in a year.

Although exports remained resilient in February (+20% yoy), Europe’s debt issues continue to be a key concern for Chinese markets – given 30% of China’s exports are reliant on Europe.

A quick look at inflation, and while the country’s inflation target was lowered to 3.5% from 4%, February CPI data came in at 3.2% – up from 2% in January. The increase was largely a result of higher food prices during the Lunar New Year period. Overall, a relatively mild inflation outlook appears to be likely, confirmed by the March CPI at 2.1%.

China’s Gross Domestic Product (GDP) growth is expected to be 8% in 2013. To further help stabilise domestic demand, one of the key policies announced in February was the 35 point plan to address the rising concerns of income equality across China.

Asia region

Making headlines last month, Japan’s PMI data for March was stronger at 50.4 compared to the February result of 48.5 – a reflection of the weaker Yen and the boost to exports. Note: a reading above 50 represents growth. More importantly, the Bank of Japan (4 April) announced a ¥140 trillion monetary stimulus over the next two years in order to stimulate economic growth. This represents a commitment to nearly doubling the monetary asset base over this period.

Australia

On the home front, the focus last month was on the speed at which mining capital expenditure declines will impact the domestic economy. There are questions around whether the non – mining sector can pick up some of the slack, and what will be the overall impact on GDP in the coming year.

However one thing is clear, the end results will play a key role in the level of unemployment and also the future direction of the current, relatively low, interest rates.

The Reserve Bank of Australia (RBA) kept the cash rate on hold at 3% at its April meeting. A statement from RBA noted ‘the inflation outlook, as assessed at present, would afford scope to ease policy further, should that be necessary to support demand’. The statement went on to say that the risks to the global economy appear to have eased in recent months, while commodity prices remained high by historical standards.

The mining sector continues to pull focus, as the latest data suggests the Australian economy is weak outside of mining.

It appears the jobs growth in mining has also peaked, and although investment currently remains largely stable, a drop-off is evident over the coming years.

Continuing with employment, although the February jobs growth of 71,000 was above expectations, and unemployment remained steady at 5.4%, these numbers remain considerably more optimistic and inconsistent with other weaker data. March’s employment data will be watched closely to see if there is any follow through of this stronger employment data.

However, the positive figures supported the RBA’s decision to hold rates steady at the April meeting, as they wait to see what trends emerge over the coming months.

In other news, housing prices across major capital cities continued to gain momentum in March, up 1.4% for the month, and 2.8% for the March quarter.

February’s improved retail sales data (+1.3%) was better than expected, while building approvals (+3.1%) also kicked in with a better performance. This data supports the RBA view that the interest rate cuts are starting to have a positive impact on consumer spending.

Australian Equities

Although the Australian market was down for the month, the March quarter (+8%) had a reasonable performance.

The S&P/ASX All Ordinaries Index has performed strongly over the rolling 12 month period to March 2013 returning 12.7%.

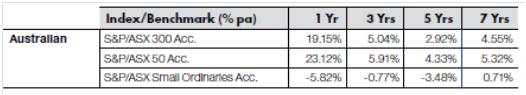

For the 12 months to March, the S&P/ASX 300 Accumulation Index has posted solid gains of 19.2%, while the large market caps comprising the S&P/ASX 50 Accumulation Index performed strongly returning 23.1%.

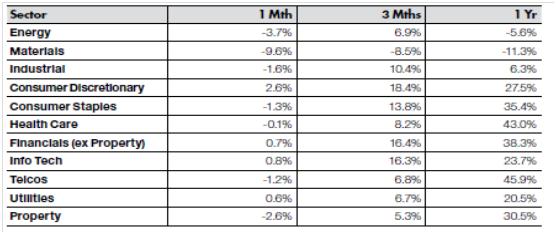

All sectors have consolidated their strong gains of the previous 8 months, although Materials have pulled back more than other sectors. This has reflected some of the uncertainty over China’s growth.

The Materials sector also continued to underperform over a rolling 12 month period.

The Consumer Discretionary and Information Technology sectors were the better performing sectors while Financials (ex -Property) and Utilities also posted positive returns in March.

The Energy sector Accumulation Index struggled during March, and was reflective of the relative underperformance over the past 12 months.

Note these are accumulation indices.

Big movers this month

Going up – Consumer discretionary +2.6%

Going down – Materials -9.6%

Equity markets

The US Dow Jones and the broader S&P500 reached all-time highs as the US economy strengthened generally.

The Japanese Nikkei Index remains the Asian equity market standout continuing its strong performance in March.

Global equities

The MSCI World Accumulation Index was up by 2.4% in March, continuing its positive run for the year.

The major global markets that posted positive gains during March included the US Dow Jones and the broader S&P500 – reaching all-time highs. The Dow Jones continued higher in March and is up 10.3% on a rolling 12 month basis.

The Japanese Nikkei Index remains the Asian equity market standout, continuing its strong performance in March and returning 23% for the rolling 12 month period.

European equity markets were generally flat during March with small gains seen throughout.

Property

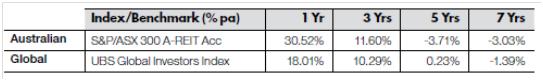

In March, the S&P/ASX 300 A-REIT Accumulation Index (-2.6%) was down marginally against the ASX 300 Accumulation Index, but has been an outstanding performer over 12 months and has contributed to the ASX industrials index performance over the rolling 12 month period. Investors continue to be attracted to the relative attractive yield produced by the sector.

On a one and three year time horizon, the Australian listed property sector continues to outperform global property. However, global property has still outperformed over the five year and seven year time periods.

Fixed interest

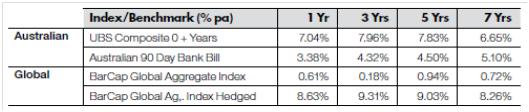

Australian bonds were marginally down in March, with the UBS Composite Bond All Maturities Index (-0.2%) marginally higher.

In March, hedged global bonds, as measured by the Barclays Global Aggregate Index Hedged, posted a 0.75% gain, while the unhedged equivalent returned -2.1%. Australian Bonds returns over the same one month period, as measured by the UBS Composite 0 + Years, were marginally lower (-0.2%), but compared well against global bonds (-2.1%).

On a 12 month basis, Australian bonds performed strongly relatively to unhedged global bonds, while hedged global bonds performed strongly.

Australian dollar (AUD)

In March, the Australian Dollar (AUD) continued to strengthen against the Yen, and was up 3.8% at the end of the month. The Japanese Government’s easy monetary policy has been reflective of a weakening currency, which has resulted in the AUD gaining 14.4% over a rolling 12 month period.

As a result of the debt issues facing Cyprus, the AUD gained 3.9% against the Euro and also gained 2.0% against the USD, rising to USD1.047.

During March, the AUD strengthened against the British Pound, up by 1.7%, and has had a reasonable appreciation over the rolling 12 month period, up 5.9%.

The information contained in this Market Update is current as at 08/04/2013 and is prepared by GWM Adviser Services Limited ABN 96 002 071749 trading as ThreeSixty, registered office 150-153 Miller Street North Sydney NSW 2060. This company is a member of the National group of companies.

Any advice in this Market Update has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on any advice, consider whether it is appropriate to your objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance.

Before acquiring a financial product, you should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.